You pay VAT on the first 28 days of a stay at a hotel, but from the 29th the accommodation is VAT free.

You pay VAT on the first 28 days of a stay at a hotel, but from the 29th the accommodation is VAT free.

HMRC has launched a new online service for the correction of errors made on previous VAT returns. Previously, a business must have emailed a correction to form to: inbox.btcnevaterrorcorrection@hmrc.gov.uk (it is still possible to use this method of reporting). The Form VAT652 – “Tell HMRC about any errors in your VAT Return” is used for any corrections of £10,000 (net of all errors) or more of VAT.

The subject of education often gives rise to complex VAT issues – as the number of Tribunal cases illustrates.

Background

A number of schools provide early or pre-school education (before compulsory education). All children aged four should be able to access an early education place and some early education and childcare services offer free part-time early or pre-school education to three year olds. This is paid for at the discretion of Local Authorities. Places for children under three in voluntary or private pre-school settings are paid for mainly by parents.

Update

In light of, inter alia, the Yarburgh Children’s Trust, Wakefield College , Longbridge and St Paul’s Community Project, HMRC has updated to reflect changes to it’s policy in respect of charities supplying; crèche, pre-school education, nursery, after-school clubs and playgroup facilities.

Business test

HMRC’s past position was that if a charity supplied nursery and crèche facilities for a consideration that was fixed at a level designed to only cover its costs, this was not a business activity for VAT purposes. Now the two-part test derived from the Wakefield College Court of Appeal case will be applied:

The activity results in a supply of goods or services for consideration. This requires a legal relationship between the supplier and the recipient. The initial question is whether the supply is made for a consideration. An activity that does not involve the making of supplies for consideration is not a business activity.

The supply is made for the purpose of obtaining income therefrom (remuneration)

General

The provision of pre-school education (without charge) is non-business; breakfast clubs and after-school child-minding/homework clubs remain non-business in the Local Authority sector even when a charge is made. This is on condition that the school offers the service strictly to its own pupils and that the fee charged is designed to no more than cover overhead costs.

Law

VAT Act 1994, Schedule 9, Group 6 – Education

VAT Act 1994, Schedule 9, Group 7, Item 9 – Health and Welfare

Businesses who import into the UK currently use Customs Handling of Import and Export Freight (CHIEF) to declare goods.

There is also a separate scheme running concurrently, known as Customs Declaration Service (CDS).

From 1 October 2022 CHIEF will cease and importers must use CDS.

Exports

CHIEF is also currently used for exports and this will continue to a later date of: 31 March 2023.

Action

This change will significantly affect all businesses which import goods. Although it is likely that import agents will handle the majority of issues, an importer will be required to:

Failure to comply with these requirements will result in a business being unable to import goods.

HMRC has issued a reminder that:

Latest from the courts

In the The Towards Zero Foundation First Tier Tribunal case the issue was whether part of the appellant’s activities could be “stripped out”, classified as non-business, and therefore result in a loss of input tax.

This case follows a long succession of recent cases on the distinction between business (economic activity) and non-business. I have considered these in other articles:

Wakefield College (referred to at this Tribunal)

Lajvér Meliorációs Nonprofit Kft. and Lajvér Csapadékvízrendezési Nonprofit Kft

and new HMRC guidance on the subject.

VAT attributable to non-business activities is not input tax and cannot be reclaimed. However, if the non-business activity is part of wider business activities then it may be recovered as input tax.

Background

The Appellant is a charity. Its primary objective is to achieve zero road traffic fatalities principally through the operation of New Car Assessment Programmes (NCAP) – testing car safety.

When it received money as consideration for carrying out the testing, it was agreed by all parties that that this represented economic activity.

As part of this activity, the charity purchased new cars (so called “mystery shopping” exercises) and carried out tests at its own expense. In this start-up phase for an NCAP it is necessary to test vehicles without manufacturer support as the independence of the testing programme is critical in order to establish consumer credibility.

The results of the tests (usually giving rise to substandard or unsatisfactory outcomes) are published and the Appellant generates publicity of the results through social media, news coverage, trade press etc. These results inform and influence customer buying behaviour which in turn drives manufacturers to improve the safety features.

As the market sophistication increases the NCAP star ratings for vehicles are used by the manufacturers in promotion of its vehicles.

The aim of the Appellant is for each jurisdictional NCAP to ultimately become self-funding through manufacturer testing fees.

Contentions

HMRC argued that when the appellant carried out tests on purchased vehicles this should be recognised as a specific activity which could not be a business as it generated no income – the tests should be considered in isolation. Consequently, the input tax which was recovered was blocked and an assessment was issued to disallow the claim.

The Foundation contended that it published the results of those tests, and this resulted in the commercial need for manufacturers to improve safety standards by way of commissions for further research. This research was funded by the car makers and was therefore economic activity. The “free” testing needed to be undertaken so as to create a market for manufacturer funded testing – the initial testing was just one element of the overall taxable supply. Consequently, all residual input tax incurred is attributed to its taxable business activities and fully recoverable.

Decision

The FTT found that it was clear that manufacturers would not proactively seek to have vehicles tested without an initial unfavourable baseline assessment. If the free testing had been a genuinely independent activity HMRC would be correct, but the evidence did not support this analysis. It found that the provision of free testing was an inherent and integral part of the appellant’s business activity.

This being the case there was no reason to attribute any VAT to non-business activities, and the input tax weas fully claimable.

Commentary

Another reminder, if one were needed, of the importance of correctly establishing whether the activities of a body (usually charities, but not exclusively) are business or non-business. The consequences will affect both the quantum of output tax and claiming VAT on expenditure. More on the topic here.

The decision was as anticipated, but this case illustrates HMRC’s willingness to challenge (often unsuccessfully) VAT treatment in similar situations.

Latest from the courts

In the Court of Appeal (CoA) case of Tower Bridge GP Ltd the issue was whether the appellant could claim input tax in a situation where it did not (and does not) hold a valid tax invoice.

Background

Tower Bridge was the representative member of a VAT group which contained Cantor Fitzgerald Europe Ltd (CFE). CFE traded in carbon credits. These carbon credit transactions were connected to VAT fraud.

The First Tier Tribunal (FTT) found that CFE neither knew, nor should have known, that the transactions it entered into before 15 June 2009 were connected to VAT fraud but that it should have known that its transactions were connected to fraud from 15 June 2009. The appeal relates only to transactions entered into before that date.

CFE purchased carbon credits from Stratex Alliance Limited (“Stratex”) The carbon credits supplied to CFE were to be used by the business for the purpose of its own onward taxable transactions (in carbon credits). The total of VAT involved was £5,605,119.74.

The Stratex invoices were not valid VAT invoices. They did not show a VAT registration number for Stratex, nor did they name CFE as the customer. Although Stratex was a taxable person, it transpired that Stratex was not registered for VAT (and therefore could not include a valid VAT number on its invoices) and that it fraudulently defaulted on its obligation to account to HMRC for the sums charged as output tax on these invoices.

Subsequent investigations by HMRC resulted in Stratex not being able to be traced.

Contentions

The appellant contended that it is entitled to make the deduction either as of right, or because HMRC unlawfully refused to use its discretion to allow the claim by accepting alternative evidence.

HMRC denied Tower Bridge the recovery of the input tax on the Stratex invoices on the basis that the invoices did not meet the formal legal requirements to be valid VAT invoices. HMRC also refused to exercise their discretion to allow recovery of the input tax on the basis that:

Decision

Dismissing this appeal, the CoA ruled that where an invoice does not contain the information required by legislation (The Value Added Tax Regulations 1995 No 2518 Part III, Regulation 14), or contains an error in that information, which is incapable of correction, the right to deduct cannot be exercised. The appellant did not have the ability to make a claim as of right.

The Court then considered whether HMRC ought to have permitted Tower Bridge to make a claim using alternative evidence. It found that the attack on HMRC’s exercise of discretion fails for the reasons contended by HMRC (above). These were perfectly legitimate matters for HMRC to take into account in deciding whether to exercise the first discretion in the taxable person’s favour.

CFE had failed to carry out “the most basic of checks on Stratex”.

So, the appeal was dismissed.

Commentary

This was hardly a surprising outcome considering that if an exception were to be made, there would be a loss to the public purse consisting of the input tax, with no corresponding gain to the public purse from the output tax that Stratex ought to have paid, but fraudulently did not.

This case demonstrates the importance of obtaining a proper tax invoice and to carry out checks on its validity. Additionally, there is a need to conduct accurate due diligence on the supply chain. I have summarised the importance of Care with input tax claims which includes a helpful list of checks which must be carried out.

Methods of calculating import value

There are six methods for calculating the value of imported goods to assess the amount of Customs Duty and import VAT a business to pay. The same value is also used for trade statistics.

All six methods are outlined below and should be tried in order. If Method 1 does not apply, try Method 2. If that does not apply, try 3 and so on. However, Method 5 can be tried before 4.

Method 1

The transaction value – the price payable to the seller. This is the most common valuation and is used in most cases.

Try Method 2 if there has been no sale of goods.

Method 2

The customs value of identical goods, produced in the same country as the imports.

Try Method 3 if there are no identical goods.

Method 3

The customs value of similar goods, which must be:

Try Method 4 if there are no similar goods.

Method 4

The selling price of the goods (or identical or similar goods) in the UK.

Try Method 5 if there are no UK sales of the goods.

Method 5

The production cost of the goods, including the cost of any materials, manufacturing and any other processing used in production.

Try Method 6 if this production cost information is unavailable.

Method 6

Reasonably adapting one of the previous methods to fit unusual circumstances.

Legislation

In the UK valuation is covered by the Taxation (Cross-border Trade) Act 2018 & The Customs (Import Duty) (EU Exit) Regulations 2018 and The VAT Act 1994, Section 19.

What to include in the Method 1 calculation

If they are not already included in the seller’s price, the importer must add the costs of:

If you import goods from a processor – ie a business that assembles or otherwise works on one or more sets of existing products to create your new imported products – transaction values can be built up by adding to the processing costs the value of any materials or components you provided to the processor.

What to exclude from your calculation

Items to be left out of the customs value if certain conditions are met include:

Further details here.

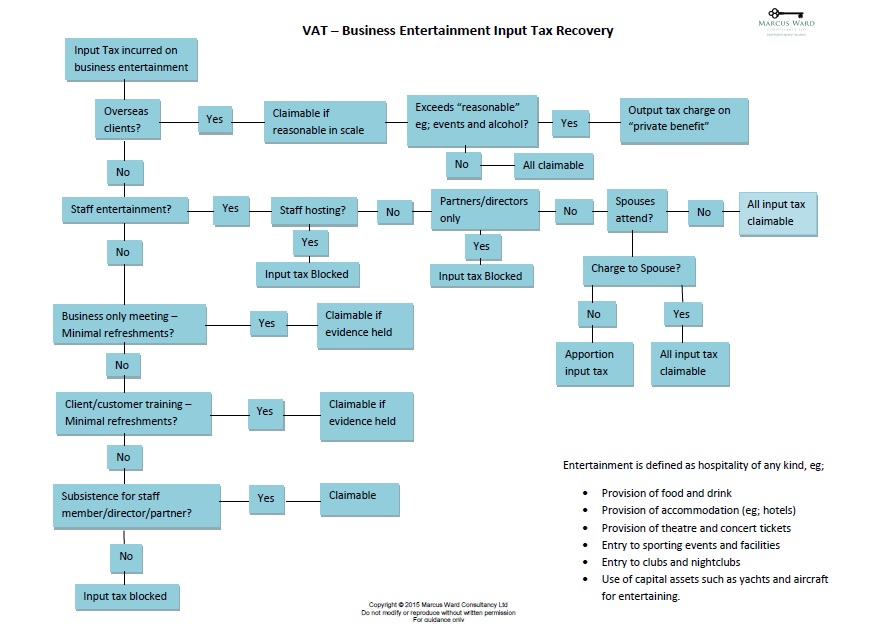

VAT – Recovery of input tax incurred on entertainment – Flowchart

One of the most common questions asked on “day-to-day” VAT is whether input tax incurred on entertainment is claimable. The answer to this seemingly straightforward question has become increasingly complex as a result of; HMRC policy, EU involvement and case law.

Different rules apply to entertaining; clients, contacts, staff, partners and directors depending on the circumstances. It seems reasonable to treat entertaining costs as a valid business expense. After all, a business, amongst other things, aims to increase sales and reduce costs as a result of these meetings. However, HMRC sees things differently and there is a general block on business entertainment. It seems like HMRC does not like watching people enjoying themselves at the government’s expense!

If, like me, you think in pictures, then a flowchart may be useful for deciding whether to claim entertainment VAT. It covers all scenarios, but if you have a unique set of circumstances or require assistance with some of the definitions, please contact me.

VAT -Business Entertainment Flowchart

Download here: VAT Business Entertainment Input tax recovery flowchart