VAT: Second Hand Scheme – Global Accounting simplification

Overview

The problem with the VAT Second-Hand Goods Scheme is that details of each individual item purchased, and then later sold, has to be recorded. This requirement can lead to a lot of paperwork and an awful lot of administration which, obviously, many businesses are not too keen to comply with.

Global Accounting is an optional, simplified variation of the Second Hand Margin Scheme (Margin Scheme).

It differs from the standard Margin Scheme because rather than accounting for the margin achieved on the sale of individual items VAT is calculated on the margin achieved between the total purchases and total sales in a particular accounting period without the requirement to establish the mark up on each individual item. It is beneficial if a business buys and sells bulk volume, low value eligible goods, and is unable to maintain the detailed records required of businesses who use the standard Margin Scheme

There two significant differences in respect of Global Accounting compared to the standard Margin Scheme. The first difference is that losses on an item are automatically offset against profits on items. Thus losses and profits are offset together in the period. In the standard Margin Scheme no VAT is due if a loss is made on an item, but that loss cannot be offset against any other profit. There is also a timing advantage with Global Accounting because all purchases made in the period are included, even if those goods are not actually sold in the same period.

Goods which may be included in Global Accounting

Global Accounting can be used for all items which are eligible under the standard Margin Scheme. However, the following goods cannot be included in Global Accounting:

- individual items costing more than £500 (although these can be accounted for via the standard Margin Scheme)

- aircraft, boats and outboard motors,

- caravans and motor caravans,

- horses and ponies, and

- motor vehicles, including motorcycles; except those broken up for scrap.

Starting to use the scheme

When a business starts using Global Accounting, it may find that it already has eligible stock on hand. It may include the value of this stock when it calculates the total purchases at the end of the first period. If a business does not take its stock on hand into account, it will have to pay VAT on the full price, rather than on the margin achieved, when it is sold.

Note: any goods bought on an invoice which shows a separate VAT figure are not eligible for resale under the scheme.

The calculation

VAT is calculated at the end of each tax period. Because you can take account of opening stock in your scheme calculations, you may find that you produce a negative margin at the end of several periods. In other words, your total purchases may exceed your total sales. In such cases, no VAT is due. But you must carry the negative margin forward to the next period as in the following example:

Period One

- a) Total purchase value of stock on hand 10,000

- b) Total purchases 2,000

- c) Total sales 8,000

Margin = c – (a+b) = (4,000)

Because this is a negative margin there is no VAT to pay. However, negative margin must be carried forward into the next period as follows:

Period Two

- a) Negative margin from previous period 4,000

- b) Total purchases 1,000

- c) Total sales 7,000

- d) Margin = c – (a + b), sales minus (purchases plus negative margin), £7,000 – (£1,000 + £4,000) 2,000

- e) VAT due = margin (£2,000) × VAT fraction (1/6) 333.33

There is no negative margin to carry forward this time. Therefore, in the third period, the margin is calculated solely by reference to sales less purchases.

The negative margin may only be offset against the next Global Accounting margin. It cannot be offset against any other figure or record.

Global Accounting Records and Accounts

A business does not need to keep all the detailed records which are required under the normal Margin Scheme – for instance, you do not have to maintain a detailed stock book.

Global Accounting records do not have to be kept in any set way but they must be complete, up to date and clearly distinguishable from any other records. A business must keep records of purchases and sales as set out below, together with the workings used to calculate the VAT due.

If HMRC cannot check the margins declared from the records, VAT will be due on the full selling price of the goods sold, even if they were otherwise eligible for the scheme.

Buying goods under Global Accounting

When a business buys goods which it intends to sell under Global Accounting it must:

- check that the goods are eligible for Global Accounting

- obtain a purchase invoice. If a business buys from a private individual or an unregistered entity, the purchaser should make out the invoice at the time the goods are purchased. If purchased from another VAT-registered dealer, the dealer must make out the invoice at the time of sale, and

- enter the purchase details of the goods in your Global Accounting purchase records. The purchase price must be the price on the invoice which has been agreed between you and the seller.

You cannot use the scheme if VAT is shown separately on the invoice.

if you are buying from a private individual or an unregistered business, you must make out the purchase invoice yourself.

When selling goods under Global Accounting

If the purchase conditions above apply, Global Accounting may be used when the goods are sold by:

- recording the sale in the usual way

- issuing a sales invoice for sales to other VAT-registered dealers and keeping a copy of the invoice, and

- transferring totals of copy invoices to the Global Accounting sales record or summary

- you must be able to distinguish at the point of sale between sales made under Global Accounting and other types of transaction

Leaving the scheme

If a business stops using Global Accounting for any reason, it must make a closing adjustment to take account of purchases for which it has taken credit, but which have not been sold (closing stock on hand). The adjustment required does not apply if the total VAT due on stock on hand is £1,000 or less. In the final period for which the business uses the scheme, it must add the purchase value of its closing stock to the sales figure for that period. In this way VAT will be paid (at cost price) on the stock for which the business previously had credit under the scheme.

Items sold outside the scheme

If goods are sold which had been included in a business’ Global Accounting purchase (for example, they are exported), a business must adjust its records accordingly. This is done by subtracting the purchase value of the goods sold outside the scheme from the total purchases at the end of the period.

Stolen or destroyed goods

If a business loses any goods through breakage, theft or destruction, it must subtract their purchase price from your Global Accounting purchase record.

Repairs and restoration costs

A business may reclaim the VAT it is charged on any business overheads, repairs, restoration costs, etc. But it must not add any of these costs to the purchase price of the goods sold under the scheme.

For further advice on any global accounting, used goods schemes, or any other special VAT schemes please contact me.

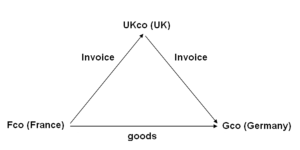

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.