How does the UK system fit with EU legislation?

Further to my recent article on the legal impact of The Great Repeal Bill and Article 50 here I thought it would be a good idea to take a step back and look at the background. We now know that on the day the UK leaves the EU the following rules will still apply and that there will be no immediate changes to the status quo. After Brexit there is likely to be a review of the VAT position, but we expect any changes to the system to be subtle at first with any significant changes (if any) being made over a much longer period.

So where are we now?

As most people will know, UK domestic VAT law is derived from EU legislation, but what is the actual relationship?

It is important to understand how both elements of legislation work in cases of dispute with HMRC as it often provides additional ammunition.

History

Most Member States already had a system of VAT before joining the EU but for some countries VAT had to be introduced together with membership of the EU.

When the UK joined the EU in 1972 it replaced two taxes; purchase tax and selective employment tax with VAT.

In 1977, the Council of the European Communities sought to harmonise the national VAT systems of its Member States by issuing the Sixth Directive to provide a uniform basis of assessment and replacing the Second Directive promulgated in 1967.

Council Directive 2006/112/EC (the VAT Directive) sets out the infrastructure for a common VAT system which each Member State is required to implement by means of its own domestic legislation. This important Directive codifies into one piece of legislation all the amendments to the original Sixth Directive, thus clarifying EU VAT legislation currently in force.

Intention

The aim of the VAT Directive is to harmonise the indirect tax within the EU, and it specifies that VAT rates must be within a certain range. The basic aims are:

- Harmonisation of VAT law

- Harmonisation of content and layout of the VAT declaration

- Regulation of; accounting, providing a common legal accounting framework

- Common framework for detailed description of invoices and receipts

- Regulation of accounts payable

- Regulation of accounts receivable

- Standard definition of national accountancy and administrative terms

EU Statements

There are four types of EU statements:

- Regulations – Are binding in their entirety and have general effect to all EU Member States. They are directly applicable in the UK legal system

- Directives – Are binding as to result and their general effect is specific to named EU countries. The form and methods of compliance are left to the addressees.

- Decisions – Are binding in their entirety and are specific to an EU country, commercial enterprise or private individual.

- Recommendations and Opinions – Are not binding and are directed to specific subjects on which the Council’s or Commission’s advice has been sought.

EU Legislation as part of UK Legislation

EU law is made effective for UK legislation via European Communities Act 1972 section 2. The effects of EU law as regards UK VAT legislation is summarised as follows.

Direct effect

The Court of Justice has held “wherever the provisions of a directive appear … to be unconditional and sufficiently precise, those provisions may … be relied upon as against any national provision which is incompatible with the directive insofar as the provisions define rights which individuals are able to assert against the state” – Becker. Also, in UFD Ltd it was stated that “in all appeals involving issues of liability, the Tribunal should consider the relevant provisions of the Council directives to ensure that the provisions of the UK legislation are consistent therewith”.

Primacy of EU Directives over UK legislation

A UK court which is to apply provisions of EU law is under a duty to give full effect to those provisions, if necessary refusing of its own motion to apply any conflicting provision of national legislation.

Interpretation of UK law

If UK VAT legislation is unclear or ambiguous, Tribunals are “entitled to have regard to the provisions of the relevant EU Directive in order to assist in resolving any ambiguity in the construction of the provisions under consideration’ (English-Speaking Union of the Commonwealth).

Legal principles

In implementing the common VAT structure, domestic legislation is required to recognise certain legal principles.

Examples of some of these are the principle of:

- Equality of citizens

- Subsidiarity and proportionality

- Non-discrimination on grounds of nationality

- Fiscal neutrality

- Legal certainty and the protection of legitimate expectations.

Practical application for most taxpayers

Practically, a result of the above is that taxpayers are regularly able to recover VAT (plus interest) paid to HMRC in error in cases where the UK domestic legislation has not implemented EU law correctly. However, HMRC has no right to recovery where VAT has been under-collected as a result of inappropriate implementation of the EU legislation.

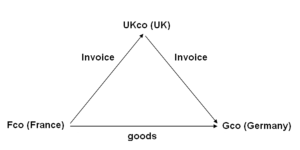

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.