Lowcost Holidays Ltd

There is a very important distinction in VAT terms between agent and principal as it dictates whether output tax is due on the entire amount received by a “middle-man” or just the amount which the middle-man retains (usually a commission). It is common for the relationship between parties to be open to interpretation and thus create VAT uncertainty in many transactions.

It appears to me that this uncertainty has increased as a result of the growing amount of on-line sales and different parties being involved in a single sale.

By way of background, I looked at this issue at the end of last year here

The case

On a similar theme, the First Tier Tribunal (FTT) case of Lowcost Holidays Ltd the issue was whether the Tour Operators’ Margin Scheme (TOMS) applied to Lowcost’s activities.

Background

Lowcost was a travel agent offering holiday accommodation in ten other EU Member States, and other countries outside the EU, for the most part to customers based in the UK. The issue between the parties is whether Lowcost provided holiday accommodation to customers as a principal, dealing in its own name, under article 306 of Directive 2006/112, the Principal VAT Directive and therefore came within TOMS or whether it acted solely as an intermediary or agent (in which case TOMS would not apply and the general Place Of Supply rules apply).

Decision

The FTT found in favour of the appellant. HMRC had argued that Lowcost was buying and selling travel and accommodation as principal, however, the FTT decided that the contracts which Lowcost entered into with; hotels, transport providers and holidaymakers were clear that the arrangement was for the appellant acting as agent. The helpful Supreme Court case of SecretHotels2 (which I commented on here) was applied in this case. The main point being that the nature of a supply is to be determined by the construction of the contract – unless it is a ‘sham’ and great weight was given to the terms of Lowcost’s contracts rather than what HMRC often call the “economic reality”. Specifically highlighted to the court was the fact that Lowcost set the prices for the holidays, which HMRC pointed out would be inconsistent with an agency arrangement. The FTT decided that this was outweighed by the actual terms of the contracts.

Consequently, as Lowcost acted as agent (for the providers of the services not the holidaymaker) the Place Of Supply was determined by reference to where the supply was received under the general rule. In this case, this is VAT free when the services were received by principals located outside the UK.

As with all TOMS and agent/principal matters it really does pay to obtain professional advice.

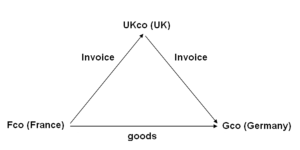

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.