Unusually in the VAT world, Triangulation is a true simplification and is a benefit for businesses carrying out cross-border trade in goods.

What is it?

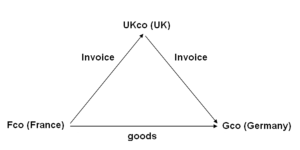

Triangulation is the term used to describe a chain of intra-EU supplies of goods involving three parties in three different Member States (MS). It applies in cases where, instead of the goods physically passing from one to the other, they are delivered directly from the first to the last party in the chain. Thus:

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

In this example; a UK company (UKco) receives an order from a customer in Germany (Gco). To fulfil the order the UK supplier orders goods from its supplier in France (Fco). The goods are delivered from France to Germany.

Basic Treatment

Without simplification, UKco would be required to VAT register in either France or Germany to ensure that no VAT is lost. That is; if registered in France, French VAT (TVA) would be charged to UKco, this would be recovered and the onward supply to Gco would be VAT free. The supply to Gco would be subject to acquisition tax in Germany. VAT therefore is neutral to all parties. Alternatively, UKco may choose to VAT register in Germany. This would mean that it would be able to produce a German VAT number to Fco so to obtain the goods VAT free. UKco would recover acquisition tax it applies to itself on the purchase and charge German VAT to Gco. Again, VAT is neutral to all parties.

Triangulation does away with these requirements.

To avoid creating a need for many companies to be structured in this way, Triangulation simplification was created via the EU VAT legislation (which is implemented across all MS) so, in this example, UKco is not required to register in any MS outside the EU.

Simplification

Under the simplification procedure Fco issues an invoice to UKco without charging VAT and quoting UKco’s VAT number. UKco, in turn, issues an invoice to Gco without charging VAT. The invoice is required to show the narrative “VAT Simplification Invoice Article 141 simplification”. Gco should account for the purchase from UKco in its German VAT Return using the Reverse Charge mechanism. Details of the Reverse Charge here

The Conditions

EU VAT Directive 2006/112/EC, Article 141 sets out the conditions which must be met for Triangulation simplification to apply. Using the example above these may be summarised as:

- There are three different parties (separate taxable persons) VAT registered in three different MS

- The goods are transported directly from Fco to Gco

- The invoice flow involves Fco selling the goods to UKco (the intermediate supplier)

- UKco supplier in turn invoices its customer, Gco

- UKco must obtain a valid VAT number from Gco (MS of destination) and quote this number on its invoice

- UKco must quote “Article 141 simplification” on its invoice to Gco.

Impact on businesses

A business may be involved in triangulation as either:

- the first supplier of the goods (Fco in the example above),

- the intermediate supplier (UKco in the example above), or

- the final consumer (Gco in the example above).

In whichever role, it is important to ensure all relevant details have been obtained and the documentation is correct.

And after Brexit?

As in many areas, we do not yet know how Brexit will affect the UK’s relationship with the EU. In general, the “worse” case scenario for UK business is that this simplification will be unavailable and all cross-border transactions will be treated as exports and imports similar to any other transactions with countries outside the EU and UK business will need to VAT register in one or more MS in the EU. This will add complexity and possibly delays at borders for goods moving to and from the UK. It is also likely to create additional cash flow issues.

In these uncertain times it makes sense to keep abreast of the (likely) changing requirements and take advantage of the simplification while it lasts.