VAT – Recovery of input tax incurred on entertainment

One of the most common questions asked on “day-to-day” VAT is whether input tax incurred on entertainment is claimable. The answer to this seemingly straightforward question has become increasingly complex as a result of; HMRC policy, EC involvement and case law.

Different rules apply to entertaining; clients, contacts, staff, partners and directors depending on the circumstances. It seems reasonable to treat entertaining costs as a valid business expense. After all, a business, amongst other things, aims to increase sales and reduce costs as a result of these meetings. However, HMRC sees things differently and there is a general block on business entertainment. It seems like HMRC does not like watching people enjoying themselves at the government’s expense!

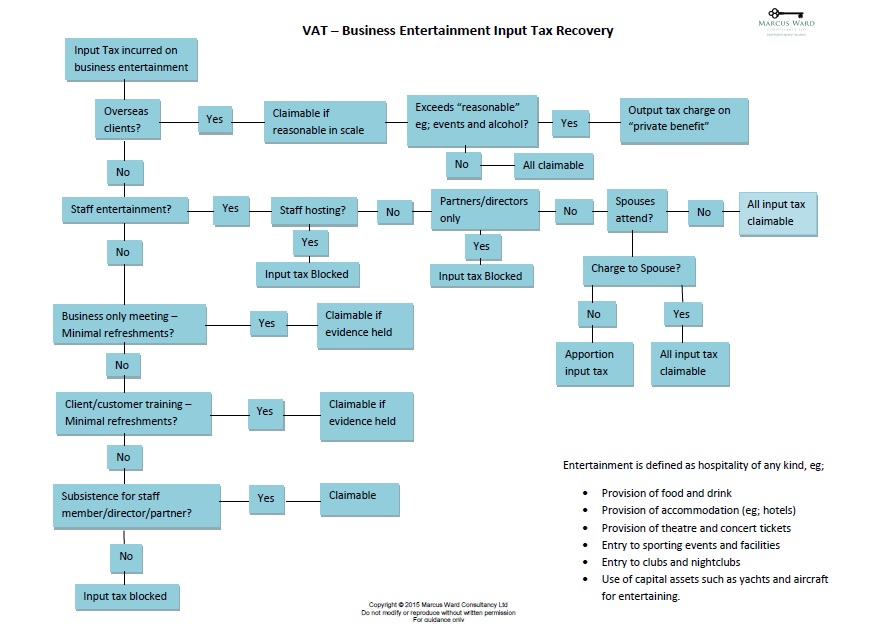

If, like me, you think in pictures, then a flowchart may be useful for deciding whether to claim entertainment VAT. It covers all scenarios, but if you have a unique set of circumstances or require assistance with some of the definitions, please contact me.

We have recently carried out a series of presentations, which, amongst other subjects, covered business entertainment. Should you require VAT training or presentations, don’t forget our comprehensive service here which can be tailored to your needs.

VAT -Business Entertainment Flowchart

Download here: VAT Business Entertainment Input tax recovery flowchart